Stock Market Crash Wipes Out ₹83,000 Crore of LIC’s Wealth. Discover the latest stock market trends, foreign investor sell-off, and LIC’s portfolio impact.

The aggressive decline that started in the Indian stock markets in October 2024 has continued into 2025, significantly impacting the portfolio of state-owned insurance giant Life Insurance Corporation of India (LIC). In just one and a half months of 2025, LIC has lost a staggering ₹83,000 crore due to market volatility.

LIC’s Market Value Declines

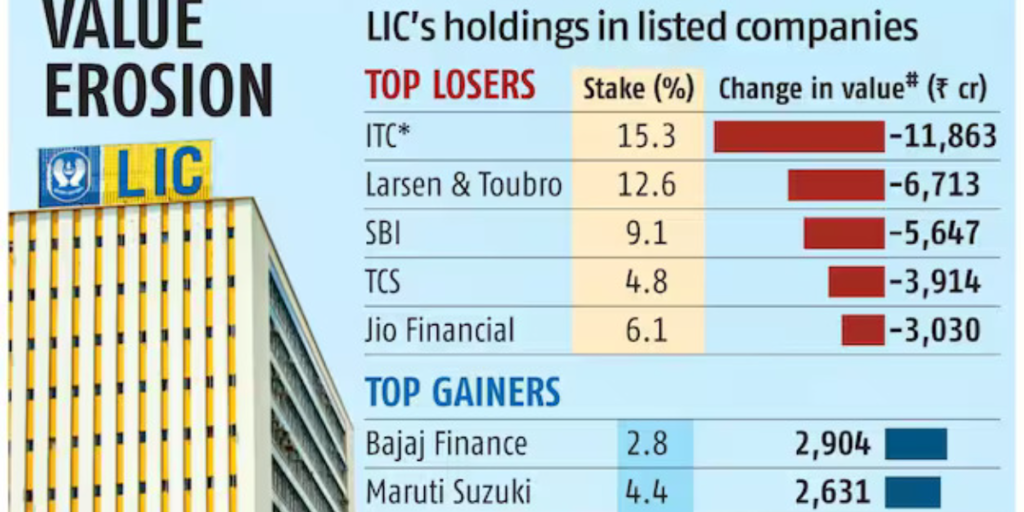

According to data from the end of the December 2024 quarter, LIC’s total holding in listed companies was valued at ₹14.72 trillion. However, by February 19, this had dropped to ₹13.89 trillion, reflecting a 5.50% decline in its equity holdings.

Major Losses in Key Stocks

LIC holds more than 1% stake in 330 companies, which account for 67% of the total market capitalization of BSE-listed firms. Some of the major stocks in LIC’s portfolio that saw sharp declines include:

- Tata Consultancy Services (TCS)

- State Bank of India (SBI)

- Larsen & Toubro (L&T)

- Jio Financial Services

- HCL Technologies, Adani Group stocks, and other financial and infrastructure firms

Foreign Investors’ Heavy Sell-Off

One of the primary reasons behind this sharp decline is massive selling by foreign investors (FIIs). Since October 2024, FIIs have sold off approximately ₹2.94 lakh crore in Indian equities, causing a significant drop in the overall market. This selling pressure has affected several sectors, including:

- Financial services

- Pharmaceuticals

- Power & Infrastructure

Stock Market Outlook: Uncertainty Ahead

Due to global economic instability, the U.S. tariff war, supply chain disruptions, and geopolitical tensions, experts suggest that the Indian stock market is likely to remain volatile. As a result, investors should stay cautious and consider a diversified portfolio to minimize risks.

Massive Wealth Erosion on BSE

In the last 4.5 months, the combined market capitalization of all BSE-listed stocks has declined by over ₹74 lakh crore from its peak in September 2024. This has led to uncertainty among investors and financial institutions alike.

LIC’s significant losses reflect the broader trend of market downturns that have affected Indian equities in recent months. With ongoing volatility and a lack of immediate recovery signals, investors must make informed decisions before investing in the stock market.

For real-time stock updates and market analysis, visit Moneycontrol or NSE India